With the looming end of federal EV tax incentives creating uncertainty for electric vehicle buyers, General Motors is making strategic moves to keep their vehicles affordable. The automaker’s significant investment in upgrading its Spring Hill, Tennessee battery manufacturing facility represents a crucial step toward producing more cost-effective electric vehicles through advanced battery technology.

The Strategic Shift to Lithium Iron Phosphate Technology

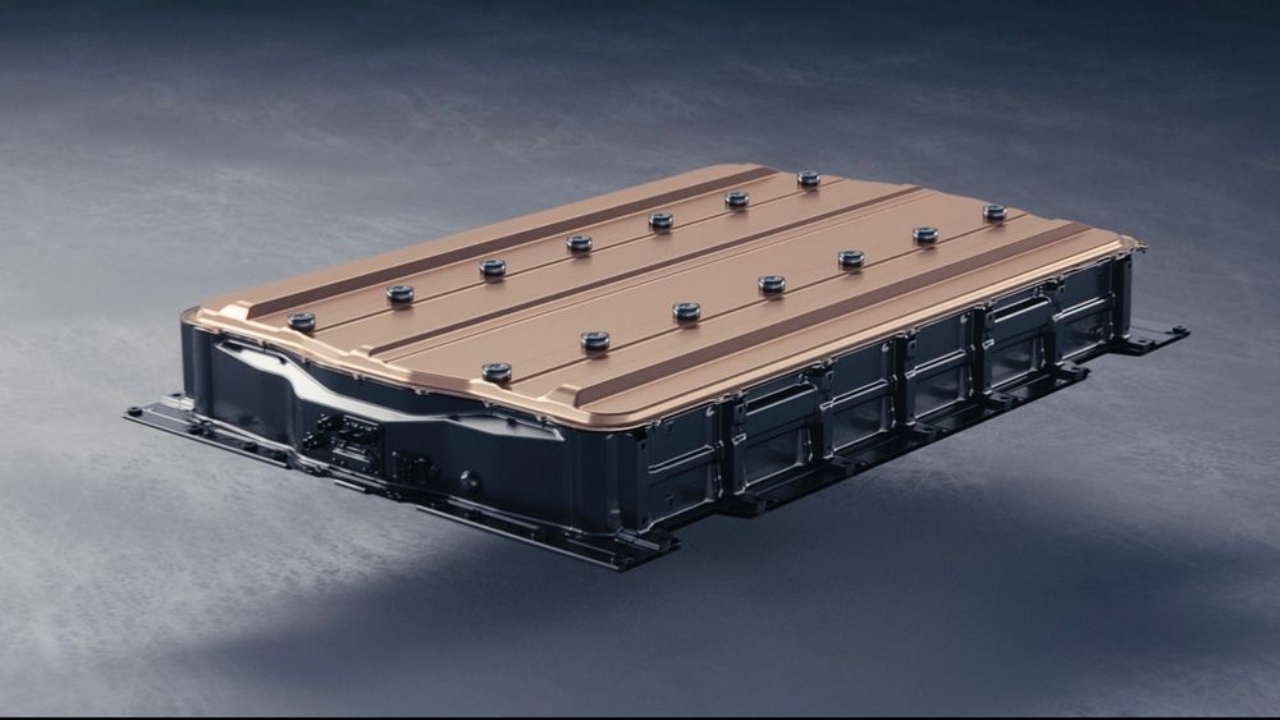

General Motors, in partnership with LG Energy Solution, is investing $2.3 billion to transform their Tennessee Ultium battery plant. This massive upgrade will enable the facility to manufacture lithium iron phosphate (LFP) battery cells, with commercial production expected to begin in late 2027. This transition marks a significant departure from the current nickel manganese cobalt (NMC) aluminum chemistry used in existing Ultium cells produced at Warren, Ohio, and Spring Hill facilities.

The timing couldn’t be more strategic. As federal EV tax credits face potential elimination, manufacturers must find alternative ways to reduce vehicle costs. Since battery packs represent one of the most expensive components in electric vehicles, any reduction in battery costs directly translates to lower MSRPs for consumers.

Understanding the Material Cost Advantage

The current NMC battery technology, while powerful and well-developed, faces significant challenges related to raw material sourcing and costs. Cobalt sourcing presents both ethical and economic concerns, while nickel prices continue to fluctuate at premium levels. These materials can cost dollars per pound for nickel and reach tens of dollars per pound for cobalt, creating inherent cost pressures in battery production.

In contrast, LFP batteries utilize iron and phosphate raw materials, which are abundant and cost-effective, often priced in cents per pound. This fundamental difference in material costs creates substantial opportunities for cost reduction without compromising safety or reliability.

Balancing Performance with Affordability

LFP Battery Advantages

The shift to LFP technology offers several compelling benefits beyond cost savings. These batteries demonstrate superior thermal stability, longer cycle life, and enhanced safety characteristics compared to traditional NMC cells. The abundant availability of iron and phosphate materials also reduces supply chain vulnerabilities and geopolitical risks associated with cobalt sourcing.

Performance Considerations

However, LFP batteries do present certain trade-offs that manufacturers must address. The primary limitation lies in energy density—LFP cells store less energy per unit weight compared to NMC batteries. This means vehicles may require larger battery packs to achieve similar range capabilities, potentially increasing overall vehicle weight.

Additionally, LFP batteries typically exhibit slower charging and discharging rates, which could impact fast-charging capabilities and peak performance delivery. However, for entry-level and mid-range EVs that prioritize affordability over ultra-fast charging or maximum range, these limitations may be acceptable compromises.

Market Impact and Manufacturing Strategy

The Tennessee plant upgrade aligns with broader industry trends toward cost optimization and domestic manufacturing. By producing batteries domestically, GM can mitigate current tariff costs while supporting American manufacturing jobs and reducing dependence on international supply chains.

This strategic move particularly benefits entry-level EV segments, where consumers are most price-sensitive and typically don’t require the highest performance specifications. The cost savings from LFP technology could make electric vehicles accessible to a broader market segment, potentially accelerating EV adoption rates.

Timeline and Production Expectations

Commercial production of LFP cells at the upgraded Tennessee facility is scheduled to begin in late 2027, providing GM with flexibility to offer different battery chemistry options across their vehicle lineup. This dual-chemistry approach allows the company to match battery technology with specific vehicle requirements and price points.

The investment represents GM’s commitment to maintaining competitive positioning in the evolving EV market while addressing consumer affordability concerns. As the automotive industry transitions toward electric mobility, cost-effective battery solutions become increasingly critical for mass market acceptance.

Frequently Asked Questions

Q: When will GM’s LFP batteries be available in vehicles?

A: Commercial production is expected to start in late 2027, with vehicle integration likely following shortly after.

Q: How much cheaper will LFP battery vehicles be?

A: While GM hasn’t disclosed specific pricing details, the significant raw material cost savings should translate to meaningful MSRP reductions.

Q: Will LFP batteries affect vehicle performance?

A: LFP batteries have lower energy density and slower charging rates, but these trade-offs may be acceptable for entry-level EVs prioritizing affordability.

Also Read:-2025 Tesla Model Y: Longer Drives Without a Price Hike